If you’re sick and tired of your Insurance premiums going up every year, we can help

We all know that the older we get, the higher the chance of becoming ill. This is why, every year, you receive that dreaded Life Insurance Policy anniversary letter that says your premiums are going up again.

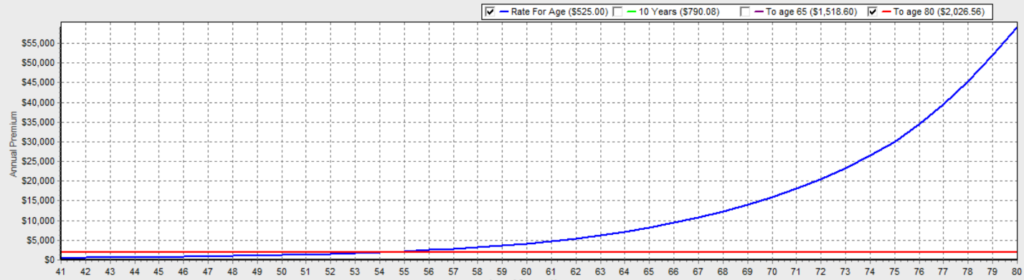

Insurance companies take into consideration a number of factors when working out how much life insurance should cost for each age group, and getting older is an obvious one… However, they can also price for Life Insurance policy premiums to remain the same for a certain period of time or to a certain age. This is called ‘Level Premium.’

For example, level Life Insurance premiums can be fixed for 10 years or level Life Insurance premiums can be fixed to ages 65, 80 or even age 100.

We do recommend that when you get to a certain age that you look at level premium options as premium rates can really really start hiking yearly as you get a bit older.

Here is an example (with one insurer as an example) below:

Male, 40 years old, non-smoker – life cover $600,000 insured amount.

While it is cheaper to take a rate for age premium earlier, your premium will always increase annually. On the other hand, taking a level premium option initially will be more expensive but your premiums will stay the same for the term nominated. This can work out to be cheaper in the long run if your budget allows it for you now.

Get in touch with MakeInsure to help you with this today.